For weeks following Israel’s murder of Hamas leader Ismail Haniyeh in Tehran on July 31, the world wondered if (and when) Iran would retaliate. Haniyeh was heavily involved in diplomatic activity to end Israel’s genocidal bombing in Gaza. He had been in Tehran for the inauguration of Iran’s new president, Masoud Pezehkian.

Iran was widely expected to react by launching a drone and missile counterattack on Israel as in April, but this time to causing greater damage. Much to the surprise of most observers, Iran took no military action. It seems that the Iranian leaders were engaged in intense diplomatic activity to arrange a ceasefire to end, or at least suspend, Israel’s genocidal bombing campaign on Gaza.

Hezbollah, the Lebanese political-religious resistance organization, was also negotiating for a ceasefire. Its leader, Hassan Nasrallah, was one of the most popular and respected political leaders in Lebanon.

Israel, the Zionist entity, whatever its diplomats might say behind the scenes, had other ideas. On September 18-19, they signaled booby-trapped pagers and walkie-talkies to blow up in Lebanon, injuring and killing members of Hezbollah as well as Lebanese civilians.

Israel went on to kill Nasrallah on September 27, taking almost 300 Lebanese civilians with him. Lame-duck President Joe Biden hailed the assassination as a “measure of justice for his many victims, including thousands of Americans.”

The October 4 edition of Peoples World reports, “Hezbollah agreed to a ceasefire hours before its leader Hassan Nasrallah was assassinated in an Israeli air strike on Beirut, Lebanese Foreign Minister Abdallah Bou Habib said … The Lebanese prime minister also said he had heard that U.S. special envoy for the Middle East Moss Hochstein was in the process of being dispatched to Lebanon to negotiate a temporary ceasefire before the assassination took place.”

After the murder, Iran launched its long-expected counterattack on Israel on October 1. Despite claims to the contrary by the U.S., many reports indicated the Iranian counterattack was effective. Many missiles penetrated the U.S.-provided “iron dome,” doing considerable damage to military targets, including Mossad headquarters located just outside of Tel Aviv.

Israel announced a limited incursion into Lebanon. But it’s been bombing Beirut, killing Lebanese, and spreading the Gaza genocide to the West Bank. Zionist entity leaders claim present-day Lebanon and most of present-day Syria, Iraq, and Egypt as part of the ancient Israelite-Judean kingdom of the biblical King David (also a prophet of Islam) given to the biblical Israelites by God Himself, despite the lack of any archaeological evidence.

As I write these lines, an Israeli attack on Iran is expected in days or weeks. The U.S. will certainly provide crucial support to this aggression, possibly involving direct U.S. forces. On October 14, some 100 U.S. military personnel landed in Israel to install and operate a Terminal High-Altitude Area Defense (THAAD) missile battery.

The horrible events unfolding in West Asia raise a question: Why is the U.S. supporting Israel with military technology and tens of billions of U.S. dollars? Many progressives believe the American Israel Political Action Committee (AIPAC) bought so many U.S. politicians, including Biden, Trump, Harris, and most members of the House of Representatives and the Senate, that it dictates Middle Eastern foreign policy against U.S. interests.

It is easy to dismiss this argument as anti-Semitic, but many who are not anti-Semitic believe it. They point out that Israel’s most militant supporters are not Jews (of whom a growing number militantly oppose Zionism and the Zionist entity) but instead are evangelical Christian Zionists.

These Christian-Zionists claim Jews must return to the land promised to Abraham — according to the Bible and the Quran is the common ancestor of both Jews and Arabs — and rebuild the biblical Temple of God in Jerusalem. Only then will Jesus Christ return to earth, bringing about the end times. Then, the true Christians — not those who do not accept the Christian-Zionist interpretation or Muslims — as well as Jews who accept Jesus Christ as Lord and Savior — will be saved. The rest of humanity will burn forever in hell. According to anti-Zionist progressives and conservative critics of U.S. support for Zionism who accept this analysis, U.S. foreign policy is controlled by a group of religious — both Christian and Jewish — fanatics.

From a Marxist viewpoint, this analysis makes no sense. It is true that AIPAC can and does bully individual U.S. congresspeople, Democrats and Republicans, who raise questions about U.S. foreign policy regarding Palestine, Lebanon, Iran, or West Asia in general. AIPAC warns if you do not stop questioning the support the U.S. government gives to Israeli genocide, we will finance a primary challenge against you and drive you out of politics entirely. This is highly effective as the power of money and U.S. electoral politics cannot be underestimated. Recent victims of this tactic include a leader of the Black Lives Matter movement, Cori Bush, who is now a lame-duck congresswoman from Missouri who lost her contest to an AIPAC-supported opponent in the Democratic primary.

When progressives complain that AIPAC is forcing the pursuit of a foreign policy against U.S. interests, they assume that the United States of America has interests independent of class, ignoring that different classes have different interests. The capitalist class has different interests than the working class when it comes to foreign policy.

If a group of Christian and Jewish religious fanatics were trying to force the government to follow a foreign policy that went against the interests of the ruling capitalist class of the United States, that class would find ways to destroy their influence quickly. AIPAC can wield its power precisely because the policies it supports coincide with the general interest of the capitalists led by its most powerful sector, finance capital. Do U.S. capitalists have an interest in the genocidal wars now raging in West Asia? The blunt answer is yes! To say otherwise is to prettify the realities of the capitalist system.

Nation-states: Gangs with bigger guns

The capitalist nation-state can be compared to a street gang on a larger scale. Street gangs are made up of aspiring merchant capitalists selling illegal habit-forming drugs. Like all forms of commodity capital, these drugs contain surplus value. The gangs divide a city or state into sectors where their members sell drugs. Their commodity capital is addictive drugs.

Like all capitalists, they are driven by competition to grab as much territory — market share — as possible. Sometimes, the gangs agree to form a cartel — to divide up a city or state. If an individual gang-banger breaks the cartel agreement, they are punished, beaten up, or killed.

But like their big brothers, our junior merchant capitalists have an interest in expanding their market share at the expense of their rivals. The cartel agreements often break down, leading to gang wars. Our aspiring, young business people in the drug business hope that someday they will become rich, legitimate, legal capitalists.

To best pursue the aspirations of their members, gang leaders try to take over rivals’ territories and even eliminate them altogether. Gang wars break out. The one thing rival gangs agree on is that no new gangs are allowed to establish themselves.

Gangs that are capitalist nation-states see things no differently. The most powerful gangs — the imperialist countries — dominated by the most powerful gang of all — the United States of America — are organized into a cartel determined not to allow any new gang (nation-state) to establish itself and take market share from any of the established nation-states. These gangs on top intend to stay there forever. Truth be told, the economic laws of capitalism leave them no choice.

Among the most important laws of capitalism is that the ability of industrial capitalists to expand the production of commodities is greater than that of the commodity markets to absorb the additional commodities at profitable prices. The imperialists will stop at nothing, including apartheid and genocide, to prevent a new nation-state from arising. The U.S. colony Israel is a tool to prevent the Arab nation (a potential nation-state) and the Iranian nation-state from growing into entities that can take market share from the U.S. and its satellite imperialist dependencies such as Germany, France, Britain, Japan, etc. Its chief enforcement arms include NATO and the Israeli Defense Force (IDF). They differ from the enforcement arms of street gangs only in the scale of their operations and greater ability to inflict damage and death. And their weapons have the power to destroy our civilization.

Capitalists have a vital class interest in preserving the gangster system (the nation-state) as it allows the individual members to live high off the hog without working. The working class and its non-proletarian allies have an interest in ending this system because if it lasts much longer, it will destroy our civilization in a gang war to end all gang wars, assuming it doesn’t first destroy the environment that makes civilization possible.

The 2024 presidential elections

I will briefly examine the U.S. presidential election, which is nearing its climax. As you might suspect, it is indeed a dismal affair.

In presidential elections, only the Democrat or Republican candidate is given a chance to win. This has been true since the war of the slave owners’ rebellion (the Civil War). Until July, the choice was between 81-year-old Genocide Joe Biden and 78-year-old Donald Trump. Both are white men—all U.S. presidents except Barack Obama, president between January 20, 2009, and January 20, 2013, have been white men. And either would be the oldest to ever serve in the Oval Office.

That changed in July 2024 when Genocide Joe was forced to withdraw after his disastrous performance in the June 27 debate with Trump. Polls showed Biden had little chance of victory. Many voters saw him as too old and in cognitive decline. How could he be expected to bear the burdens of office over the next four years?

This isn’t the only reason his poll numbers were falling. Though both parties serve the interests of finance capital, Republicans appeal to most reactionary voters, while Democrats appeal to progressives. As a rule, individual members of the capitalist class prefer the Republican party. Individual capitalists, especially those who are African American, Arab American, Hispanic, Muslim, Asian American, and Jewish American who are members of oppressed or historically vulnerable communities, tend to prefer the Democrats.

Beyond the capitalist class, Democrats depend on the votes of industrial union members, especially non-white and female workers, African Americans of all classes, working-class Latinos, Arab Americans of all classes, Muslim Americans of all classes, Jewish Americans of all classes, some small farmers and idealist, progressive though misled students and intellectuals. The same goes for the leaders of women’s organizations and the LGBTQ+ community. The Republicans beyond the capitalist class proper do best among small business owners, white males of all classes, white male conservative craft union members and more prosperous farmers, reactionary intellectuals, and racists and bigots of all classes.

This year, the Democrat coalition has been under great strain. The most important factor has been the genocide in Gaza that threatens to spread to the West Bank and Lebanon. This means that Democrats will have a tough time winning votes in the Arab and Muslim communities. Many in the African American community who normally vote for Democrats but sympathize with the Gazans and other victims of the genocidal terror of the Zionist entity are finding it difficult to vote for the Democratic ticket this year. The same is true of working-class Latinos and progressive students from Christian, Muslim, or Jewish backgrounds who have spearheaded the anti-genocide movement.

As I explained last month, the capitalists financing Biden decided after the June debate that they would refuse to give any more money to the Democratic campaign until he stepped aside in favor of his vice president, Kamala Harris. Harris is a woman of mixed Jamaican and South Asian Indian ancestry who would be the first woman of color to serve as president. Relative to Biden and Trump, she is young at 59 and, from the viewpoint of the progressive Democratic base, a more attractive candidate than Biden (which isn’t saying much).

From the progressive point of view, there are big problems with Harris. The biggest is she has done nothing to disassociate herself from Genocide Joe’s policy of financing and giving direct military support to Israeli genocide in Gaza, the West Bank, and Lebanon.

Despite Biden’s months-long claims that a ceasefire was just around the corner and Harris’ failure to put any space between her and Biden on the Gaza genocide, it is not surprising she is polling poorly among Arab-American and Muslim voters. Nor has she taken off among African Americans or Hispanic voters.

Instead, polls show high support for the Republican Trump among African American men and Arab and Muslim Americans despite his notorious racism and Islamophobia. Moreover, in the latter group, there is also high support for Green Party candidate Jill Stein — the only Jewish-American in the race, if we leave out the insignificant pro-genocide “socialist” campaign of the Socialist Workers Party’s Rachel Fruit. Stein, unlike the two main capitalist candidates, Harris and Trump, strongly support the anti-genocide movement. (1)

Winning a solid majority among progressive voters is generally considered a must for Democrats to win. Harris has another disadvantage: Despite the Democratic and media boasting on how wonderful the economy is (the stock market is at record levels), the polls give both Biden and now Harris low grades regarding the economy. No wonder, considering the punishing inflation that marked the Biden years. Even official unemployment is over 4%, far from the record low unemployment Democrats have boasted about.

Recently, Harris has been moving further to the right. She’s promised to appoint a Republican to her cabinet and has been emphasizing the support she is receiving from George W. Bush’s war-mongering vice president, Richard Cheney. She hopes that she can gain votes, which she’s losing on the left, by winning some on the right from Republicans who cannot stomach Trump.

Some promises the Democrats failed to keep

The Democrats’ strongest issue is the Supreme Court’s notorious Dobbs decision that took away the right of abortion as a constitutionally guaranteed right. This led to an unusually wide spread between male voters who tend to vote Republican and female voters who tend to vote Democratic. If Harris manages to scrape through, this will be the reason why.

The Democrats failed when they had a majority in both houses of Congress and the White House during the first two years of the Biden administration to pass a federal law protecting abortion, with the excuse that Senate Republicans would have filibustered to block such legislation. But if Senate Republicans had done this, the difference between the two parties on this issue would have been highlighted. Since the majority of the population supports a woman’s right to choose, the reactionary position of the Republicans would have been costly. This would have incentivized millions of voters to show up at the polls in November to elect Harris and throw out the Republicans.

Democrats could have proposed a constitutional amendment to override the Supreme Court’s decision. Given the current balance between Democrat and Republican officeholders in state legislatures, this would not have passed. (2)

If the proposed constitutional amendment was backed up by a vigorous campaign explaining the right of women to control their own bodies to millions of people, they might turn out on election day and throw out Republicans in state legislatures where they are deeply entrenched. Democrats claim that Republicans are a fascist or a semi-fascist party that is a direct threat to traditional U.S. democracy.

A campaign around a constitutional amendment to override Dobbs could play a crucial role in defeating this semi-fascist party at all levels and helping save U.S. democracy. But the Democrats again were missing in action. If Republican Supreme Court justices had seen Democrats building such a movement, they might have thought twice before going ahead with their decision, if only in fear of their party’s weakening.

Another example is the Voting Rights Act proposed by late Georgia’s long-term African American Representative and civil rights leader, John Lewis. This would be a sure winner for the Democrats since, for decades, African Americans have been the most consistent supporters of the Democratic Party in electoral contests against Republicans. Again, Democrats failed to deliver.

Then there is the case of the Protecting the Right to Organize (PRO) Act, which essentially repeals the 1947 Taft-Hartley Act passed by the Republicans, which has done so much damage to labor rights and unions.

The progressive podcaster Kyle Kulinski has denounced Israeli genocide but is supporting the pro-genocide Harris-Waltz ticket. It’s a little like back in the 1920s or early 1930s, Germany passionately denouncing Nazi anti-Semitism but urging a vote for Hitler’s National Socialist Party anyway because you agree with the Nazis on other issues. Kulinski pointed out that with one exception, all Democrats support the PRO Act, while every Republican congressperson and senator opposes it. On the crucial question of basic labor rights, there appears to be an important difference between the Democrats and Republicans. Kulinski omitted a little detail: When Democrats had a majority in Congress during the first two years of Biden’s term, they failed to pass the PRO Act.

Biden broke his promise to provide a public option to improve Obama Care and didn’t reinstate the child tax credit implemented during the COVID shutdown period. After abortion, health care, in general, is perhaps the greatest vulnerability the Republicans have due to their failed attempt to repeal the Affordable Health Act during the last Trump term.

The Democrats did pass the Inflation Reduction Act, which included spending on public works in the interests of big business. It also included steps to privatize public works. Other elements of the legislation that were in the interests of workers were spun off in a separate bill that was not passed. The same could be said about climate legislation. Unlike Republicans, Democrats fake concern about the climate crisis but pass laws that support increased drilling.

Progressives point to the so-called CHIPS act that aims to increase the production of computer chips in the U.S. or countries considered safely under U.S. domination. But this bill is part of the ruthless commercial war to prevent the development of China and is inseparable from the racist anti-China campaign that could lead to World War III.

The real solution, only possible under a global socialist system building a communist society, would be to build on the achievements of Chinese, U.S., and scientists and engineers of all nationalities to use semiconductors and other computer technology to meet human needs. The mercantilist principles that underlie the CHIPS Act are heading us straight to war with China.

This leaves the economy, which polls have regularly indicated is a strong issue for Trump and the Republicans. Defenders of the Biden-Harris administration record claim that unemployment has been at record-low levels and inflation has been licked.

With the dollar price of gold hovering at or near record levels, there’s a danger of a significant outbreak of currency depreciation inflation. In addition, inflation stemming from a major war from U.S. support for Israel in West Asia and the Nazi-ridden Euromaidan regime in Ukraine remains a highly acute danger.

In the coming months, the danger of recession with skyrocketing unemployment or a sudden acceleration of inflation followed by deep recession will only increase. Of course, the supporters of the Harris-Walz campaign are not explaining this. Instead, they prefer to prattle about “blowout job numbers,” “soft landings,” and fading inflation. But if polls are to be believed, the electorate is not buying it.

Let’s examine the blowout jobs numbers, remembering that unemployment is usually lower than usual under capitalism just before a recession. The media have once again reported “blowout” job numbers when the U.S. Labor Department estimated that the U.S. economy created 254,000 new jobs, considerably more than the less than 200,000 that had been expected.

Since the U.S. Labor Department had just announced a few weeks before that it greatly overestimated job creation earlier this year, you would think that a responsible media would be reporting this latest Labor Department job creation “estimated” a little bit more critically rather than running headlines of blowout job creation numbers.

If we looked a bit more closely at the Labor Department data, we would see that a degree of skepticism by the media would indeed be justified. For example, why did the Federal Reserve System reduce its target for the Federal Funds Rate by 0.50 basis points if the economy is creating so many new jobs? The central bank has its own sources of information on what is happening in the business world that was presumably out of whack with the jobs numbers that the U.S. Labor Department reported. But there is more.

NBC News reported: “A significant caveat to the report was the rate of response to the Bureau of Labor Statistics’ monthly survey: At just 62%, it was the lowest for a September report since at least 2010. That could set the stage for a substantial revision next month as more data comes in.”

In other words, the September jobs report should be taken with a grain of salt, especially in light of recent Labor Department overestimations of the jobs created until more data comes in. Also worth noting, according to the Labor Department data, employment declined in the crucial manufacturing sector. Employment changes in manufacturing tend to lead changes in other sectors of the economy. It should be noted that over the next few months, the employment reports will be harder than usual to interpret due to the devastating effects of the back-to-back global warming-fueled hurricanes Helene and Milton that have caused massive damage. These include destroying homes and businesses and prolonged power failures caused by wind damage and massive floods. (3)

Considering all these facts, did the media insist on running headlines about “blow out” job numbers rather than report the facts truthfully? The basic reason is that the capitalists who own the media and run the media as a profit-making business desire considerable unemployment. The capitalists, as buyers of labor power, want this commodity to be plentiful and cheap. The more abundant and cheaper the commodity labor power is, the higher the ratio of unpaid to paid labor — the rate of surplus value — which increases the rate of profit.

The last thing the capitalists desire is for their government to launch programs to help the unemployed or reduce unemployment, which would make the commodity labor scarcer and decrease the ratio of unpaid to paid labor, thus lowering profits. Although capitalists generally dislike deep recessions — since they can make the realization of surplus value difficult or impossible — they still have an interest in presenting a significant level of unemployment as if it were “full employment.”

This year, there is an additional factor at play. While many individual capitalists — Elon Musk or the MyPillow guy Mike Lindell, to name just two — support Donald Trump, and there are many others. The capitalists of the Party of Order very much want Kamala Harris to defeat Donald Trump.

During his first term in office, Trump pushed his own ideas on foreign policy. These included trying to withdraw U.S. troops from the oil-producing regions of northeast Syria — the Party of Order sabotaged that, the U.S. troops are still there denying Syria its oil — and making attempts to improve relations with Russia — also successfully sabotaged by the Party of Order — as well as normalizing relations that Peoples Democratic of Korea (North Korea), also sabotaged by the Party of Order.

It should be pointed out that not all of Trump’s initiatives in foreign policy have been opposed by the Party of Order. The Trump policies that the Party of Order supported and were continued by the Biden-Harris administration include:

- Canceling the agreement with Iran to allow Iran to develop nuclear power for peaceful purposes — not for weapons — in exchange for intrusive inspections;

- Cutting back on Obama’s moves to partially normalize relations with Cuba and instead tightening the economic blockade of Cuba;

- The growing economic war with China.

In addition, Trump has shown little respect for institutions that have served the U.S. capitalist class so well for decades and some for centuries. Most shockingly, he refused to concede the election to Biden even when it became clear that he had lost the popular vote by seven million and lost the electoral college. Instead of congratulating Biden and telling his followers to support the new president since “we are all Americans,” he has continued to claim without any evidence that the election had been stolen from him.

He spent the final months of his presidency attempting to find a way to remain in office illegally. Finally, on January 6, 2021, he supported a violent attack on the U.S. Capitol by a mob of his supporters who delayed for hours the formal certification of Biden’s victory. The mob even issued threats against Vice President Mike Pence, seemingly with Trump’s explicit approval, due to Pence’s refusal to comply with Trump’s demand to abstain from his ceremonial responsibilities in certifying the election of Joseph Biden as president and Kamala Harris as vice president.

This amounted to an attempted putsch to stay in office illegally. These are events without precedent in U.S. history. You would think that Trump would be out of presidential politics forever after these events. But here it is four years later, and if the polls are to be believed, he can win the 2024 presidential election.

Earlier this year, Trump was convicted on felony charges in New York State — and he has been indicted on many more, both state and federal — so he is going into the election a convicted felon and under indictment for many more felonies. Never before, as far as I am aware, has a person convicted on felony charges by a capitalist court been elected to a major office, let alone served as U.S. president. The closest precedent would be George W. Bush, who, as a young man, was convicted of a DUI — drunk driving — misdemeanor. And Trump is supposed to be the “tough on crime law and order” candidate! (4)

The Party of Order that controls the great majority of the capitalist media is going overboard to paint a picture of a thriving U.S. economy in the hope of somehow convincing enough voters to pull the lever for Harris and Walz. But as of mid-October, it is very far from certain they will succeed. The Party of Order wants a “responsible” — to them, that is — president rather than the adventurer Trump because U.S. imperialism is in serious trouble in many parts of the world.

This includes the West Asia region and Ukraine, where the defeat of the Nazi-ridden Euromaidan regime seems to draw ever closer. If things continue to go the way they have been going recently, Washington will soon have to choose between intervening openly in the war — or at least risk it by giving Kiev not mere drones but missiles that can strike deep into Russia — or stage a retreat that would keep Ukraine out of NATO and make the resource-rich country a much more dangerous place for U.S. and Western investments.

Finally, there is the question of Taiwan, which involves nothing less than control of the world’s semiconductor market from Washington’s point of view. As the CHIPS Act shows, Washington is making an all-out effort to maintain its monopoly on this market. If the U.S. loses this crucial market to China, the whole position of the U.S. world empire will be radically undermined. But any wrong move by Washington could unleash a shooting war between the U.S. and China with horrendous consequences.

Finally, there is the possibility that wars or threatened wars in West Asia, Donbass-Ukraine-Russia, or a possible war over Taiwan — and the Korean peninsula remains a flash point as well — could merge into a third world war.

In addition, Trump’s extreme racist right-wing politics alienate the majority — not all, of course — of the U.S. population that goes far beyond those who choose to, or can, vote in the U.S. presidential elections. Trump’s Bonapartist tendencies, so much in evidence on January 6, 2021, threaten to upend the entire U.S. political system and radically destabilize capitalist rule. From the viewpoint of the Party of Order capitalists, Harris and Walz’s election in November is very much desired.

Harris, as a tough “law and order former California prosecutor,” if elected, will surround herself with experienced imperialist advisors who have spent their entire adult lives trying to figure out how to maintain and expand the power of the U.S. world empire. During his previous four-year term, Trump’s foreign policy advisors were either fired or quit when their attempts to control him were frustrated. The Party of Order can ill afford to spend the next four years fighting Donald Trump when it views the great majority of the world’s people as its real enemy. The fact that despite all of this, Donald Trump has an excellent chance of winning in November shows how far the U.S. world empire has already fallen into decay.

Next month after the election, when the outcome of the U.S. election may be clear — though it may not be — I will take a closer look at the world situation.

But for now, I want to return to examining how long-term changes in the production and value of gold affect the evolution of the world capitalist economy. The following month I will examine the economic crisis and the role that depletion of South African gold mines played in it.

Gold and the quantity theory of money

You often read in history books that the discovery of gold and silver in the Americas during the 16th century increased the quantity of gold and silver. The consequent increase in the quantity of gold and silver money caused prices to rise. This aligns with the quantity theory of money, a pillar of neoclassical economics. On the contrary, Marxists explain that the discovery of rich gold and silver mines in the Americas during the 16th century lowered the value of gold and silver relative to most other commodities. Since gold and silver had lower values, it took greater quantities of gold and silver to buy a given commodity than previously. Prices measured in terms of gold and silver rose.

But how does a change in the value of the money commodity in a capitalist economy — from here on, we will assume that the money commodity, also called money material, is gold — affect prices? Assuming the value of other commodities remains unchanged, what are the mechanisms through which a change in the value of gold would bring about a change in prices? According to the quantity theory of money, an increase in the quantity of money — everything else remaining equal — will increase prices proportionate to the increase in the quantity of money relative to the quantity of commodities. This claim includes a series of assumptions. Its central assumption is that the normal state of a capitalist economy is “full employment” both of the means of production and potential workers.

The quantity theory of money assumes that the capitalist economy is operating at full employment and that all existing money that can circulate will circulate. Any increase in the quantity of money — such as, for example, the discovery of rich new gold mines — will expand the quantity of money circulation. Since the economy is assumed to be at “full employment” of both workers and machines, the production of commodities can only increase gradually. If, due to the discovery of rich new gold mines, the quantity of money in circulation increases faster than the quantity of non-money commodities, demand can only be equalized with supply by price increases.

But in reality, the normal condition of a capitalist economy is one of considerable unemployment of both the means of production and of potential workers — the reserve industrial army. Actual full employment virtually never occurs outside a full-scale war economy such as World War I or World War II. War economies cannot last for too long because, in a war economy, production must be diverted from producing means of production to producing means of destruction. In a full-scale war economy, productive capital — the physical means of production both in physical and value terms — is not expanding but contracting. Unlike in “peacetime,” the means of production, as well as the workers not in uniform are fully absorbed into production.

Full-scale war economies mean all-out war and all-out war leads to the death of many workers in uniform, shrinking the number of workers available to produce surplus value. The shrinking quantity of workers — variable capital — means a reduction of variable capital, which alone produces surplus value. Since the capitalist mode of production cannot exist for long without the expansion of variable capital that produces surplus value, full-scale war economies can last only for a limited period of time. More limited wars that do not need a full-scale war economy can last much longer. Compare, for example, the length of the Afghan war fought by the U.S. from 2001 to 2021 with World War I or World War II.

Leaving aside full-scale World War I or World War II war economies, the proportion between the means of production and the employed workers on one side and the idle means of production and unemployed workers on the other varies with the phases of the industrial cycle. The same is true of the supply of money. A portion of the total quantity of money lies idle in the banking system, while another portion is in circulation. The portion of the total money supply in active circulation, as opposed to lying idle in the banks, is much greater during a boom than in the post-crisis stagnation/depression phase.

We have seen throughout this blog that the total quantity of money in terms of its purchasing power — not in terms of nominal currency such as dollars, euros, pounds, etc. — is ultimately limited by the quantity of gold that forms the actual “monetary base.” The inverted pyramid of legal tender money and commercial bank-created credit money is built on top of the golden monetary base.

This remains true even when there is no legal relationship between the quantity of legal tender currency that is created by the central bank and the quantity of gold. Under the current monetary system, when gold is plentiful relative to non-money commodities at existing prices, the central banks can follow more expansionary monetary before the demand for gold gets out of hand and unleashes currency depreciation inflation than it can when gold is scarce relative to non-money commodities.

During periods of depression, the ratio of potential currency relative to active currency is much higher than during periods of boom. Under average conditions between boom and depression, just as there is a considerable quantity of idle means of production and unemployed but potentially employable workers, a considerable quantity of money is lying idle in the banks.

Additional currency in the form of commercial bank-created credit money can be created when necessary. Additional currency will be necessary when the circulation of commodities in terms of commodity use values at existing prices rises, or by higher commodity prices, or as is usually the case, by some combination of higher commodity prices and increased commodity circulation.

How a monetary system based on inconvertible legal tender money works

Let’s say we have average business conditions. Assume that the discovery and development of rich new gold mines put downward pressure on the dollar price of gold. With the dollar price of gold falling, there is no danger of dollar depreciation inflation, nor is there much danger of inflation brought on by scarce commodities because, due to unemployment and idle capacity, the production of commodities can be increased very quickly if demand increases.

The Federal Reserve System can reduce its target for Federal Funds. Since the inflation rate will be below the Fed’s 2% target for inflation, the Fed will able to reduce its target for the Federal Funds Rate to very low levels. Contrary to the quantity theory of money, this will create little or no additional inflationary pressure. Instead, we see a growth in demand, a rise in the number of employed workers, and a decline in excess capacity.

The operation of the multiplier effect and the accelerator effect will push the economy toward a situation where there are far fewer idle productive forces and fewer unemployed workers. The greater the quantity of idle productive forces and workers, the faster the level of production can be expanded.

There is little or no inflation as rising production keeps up with increasing demand.

If there is an unusual expansion in the quantity of money due to the discovery of rich new gold mines, at some point, high utilization of the existing productive forces and workers will make a further expansion of production a much slower process. To increase production to meet the growing demand for commodities under these new conditions, the means of production must be created, and the size of the potential workforce must be expanded. As the economy gets closer to the full utilization of the existing productive forces, including potential workers, the rate of further production increases will slow down.

As excess capacity drops, the competition between sellers declines while the competition among buyers increases. This will cause prices to increase because only through higher prices is it possible to equalize supply with demand. Only at this point will the increase in the production of gold due to the discovery of rich new gold mines finally express itself in higher prices not only in terms of dollars or other paper currencies but in terms of gold as well.

There is a limit on how much prices in terms of gold as opposed to prices in terms of paper dollars can increase. Eventually, market prices calculated in terms of gold will rise above the new higher prices of production. This will cause the production of additional gold to slow down.

Contrary to the quantity theory of money, commodity prices, as measured in terms of gold bullion, will not immediately fall just because the quantity of gold is now growing slower than the quantity of (non-money) commodities. Instead, as gold gradually becomes relatively scarcer relative to non-money commodities, interest rates will rise. Higher interest rates are necessary to reduce the demand for gold back to the supply of gold. But as the relative increase of (non-money) commodities relative to gold — overproduction — continues to rise, interest rates will keep on rising. Money becomes increasingly tight.

The velocity of circulation of currency will increase to the maximum possible that the technical conditions allow, and the ratio of currency in circulation relative to bank reserves will keep rising. At some point, the ability of the banking system to create additional means of circulation will reach its limit. At that point, an economic crisis will break out that will lower the prices of commodities measured in terms of the use value of gold.

A fall in the value of gold relative to the value of (most) non-money commodities increases the prices of production measured in terms of now cheaper gold. Assuming that the change in the value of gold relative to the value of commodities is permanent, once the prices have fully adjusted to the new values, then things will be the same as they were before. The only difference will be that market prices will now fluctuate around a higher axis of production prices than before.

There will be a transition period when market prices rise towards the new higher axis but have not yet reached it. During this transition period, the rate of profit measured in terms of money material will temporarily rise. Since profit is the only motive for production under the capitalist system and is measured in terms of the use value of the money commodity, a temporary rise in profits will stimulate growth even if the rate of profit in terms of value remains unchanged. The faster rate of economic growth will end once market prices fully reflect the change in the relative values of gold and other commodities.

The accelerated economic growth that occurs as market prices rise toward the new higher prices of production means a period of higher-than-average demand for labor power that will end once market price prices fully reflect the lower value of gold. Production prices are constantly changing, while market prices fluctuate around production prices. This process is the market’s way of keeping market prices near production prices. Prices of production are, in turn, determined by their labor values with some modifications.

Value rules price not by market prices at any given time being equal to prices determined by values but rather by what Anwar Shaikh stresses is a turbulent movement. The turbulent movement is a process of ever-changing values and prices of production, with market prices fluctuating around an axis ruled by ever-changing values. This movement appears anarchic and accidental, but through this very anarchy, the supreme economic law that rules capitalism — the law of the value of commodities — exerts itself.

Historical evidence

A classic example of a rise in prices brought on by a fall in the relative value of gold is the wave of price increases combined with a temporary rise in the rate of economic growth and accelerated demand for labor power is the economic prosperity that swept through the capitalist world begin in 1896 and continuing until the eve of World War I.

The introduction of the cyanide process made it possible to extract gold far more cheaply from poor ores, and the discovery of gold in the Klondike in 1896 reduced the value of gold relative to the value of other commodities. This was an ideal environment for the growth of the labor unions and the Social Democratic parties of the Second International. It also created a favorable opportunity for the growth of opportunism within those Social Democratic parties.

Earlier in the 19th century, we had the mid-Victorian boom that followed the discovery of gold in California in 1848 and Australia in 1851. This process was repeated in the years after the discovery of gold in the Klondike in 1896. Immediately after these discoveries, periods of generally falling prices and depressed economic conditions gave way to periods of rising prices, a rise in the rate of profit, accelerated economic growth, and high demand for the commodity labor power.

What about the 20th and 21st centuries? Unlike the 19th century, the 20th and, so far, the 21st have not seen the speculator geographic discoveries of gold that the 19th century saw. With the world now fully explored by capital, it is becoming ever less likely that there are large accessible rich gold-bearing lands that have not already been discovered.

During this latter period, peaks in gold production followed each other about every 30 years, give or take a couple of years. Whether the apparent 30-year gold production cycle is a cyclical phenomenon or an accidental pattern is an interesting question that I don’t have space to explore fully here. In the 19th century, the discovery of gold in California and Australia in 1848 and 1851 and again in 1896 was accidental. As we have seen, it is no accident that there have not been similar geographical discoveries after 1896.

There have been many more minor discoveries of gold, but none on the scale that Marx and Engels witnessed in the middle of the 19th century. Marx described the gold discoveries of 1848 and 1851 as a second 16th century. The gold and silver discoveries of the 16th century marked the beginning of the world market — called the commercial revolution by capitalist historians — that effectively launched the world capitalist system.

Another “16th century” began in 1896, right after the death of Frederick Engels. By the beginning of the second decade of the 20th century, the Klondike mines were facing depletion, and the “16th century” that nurtured Second International and the Social Democratic parties was over.

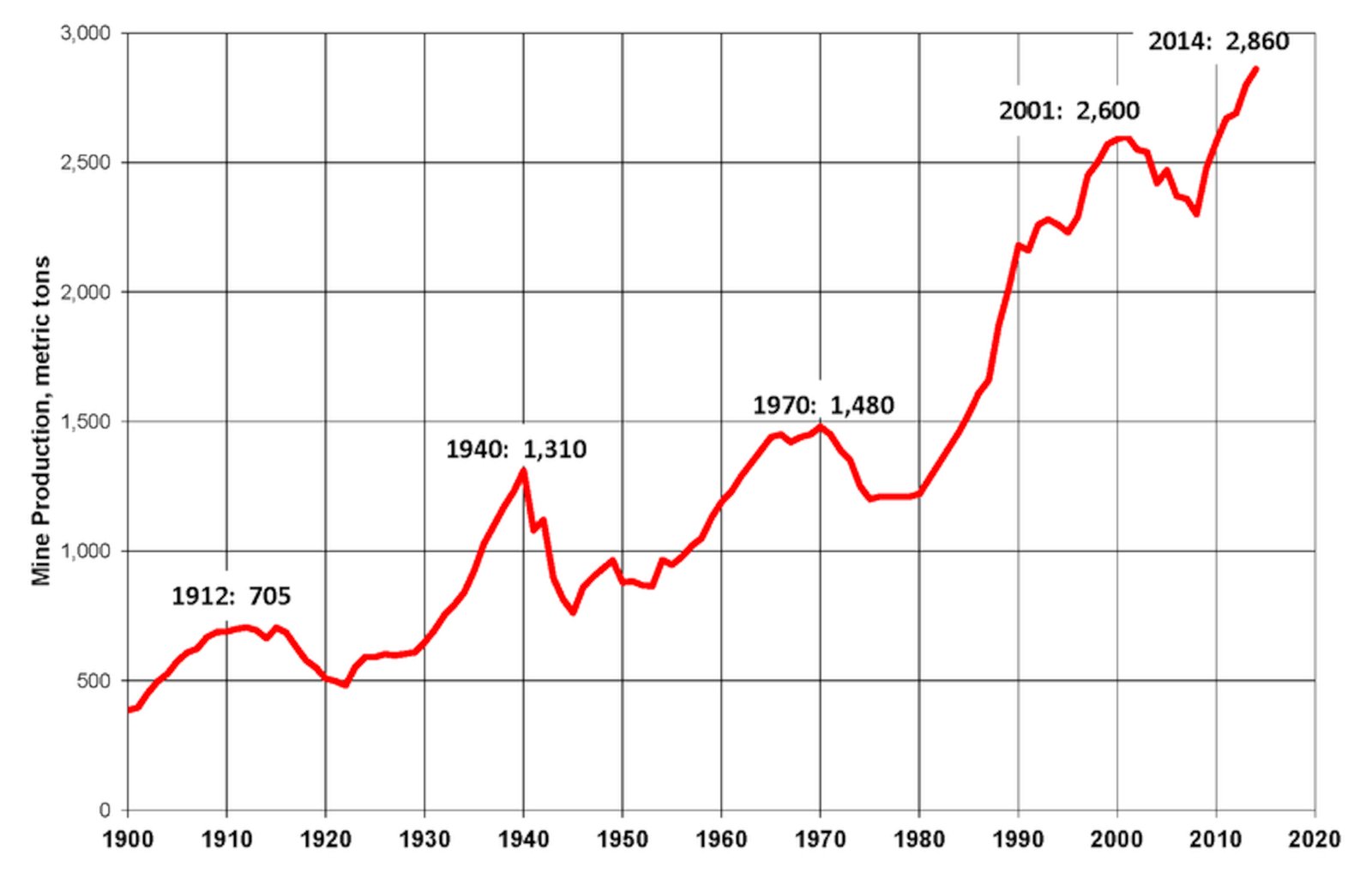

This new “16th century” was replaced by a new era of war, revolution, and catastrophic economic crises. Let’s examine what happened in the years between 1912, when gold production peaked at 705 metric tons, and the year 2014 when gold production peaked at around 2,860 metric tons. Despite the lack of speculator geographic finds, such as the California and Australian discoveries in 1848 and 1851, respectively, or the 1896 Klondike discoveries, the annual production of gold increased from 705 metric tons in 1912 to 2,600 metric tons in 2001. By 2014 — not a peak year for gold production — the annual production of gold increased further, reaching 2860 tons.

Between 1912 and 2014, the annual production of gold had increased more than four times. Would capitalism still exist today if gold production had not risen above the 1912 levels? It seems unlikely.

Since 1912, there have been definite depressions in gold production approximately every thirty years. We can identify three distinct thirty-year “cycles” — if they are true cycles — from 1912 to 2001, measuring from peak to peak. The most significant and prolonged decline occurred from 1912 until the super-crisis of the early 1930s. This cycle ended with another peak in 1940, marking it as the most substantial overall increase in gold production among the three identified cycles. Between 1912 and 1940, global gold output rose by 85.58%.

The only reason gold production peaked in 1940 was the outbreak of World War II, implying that the almost regular thirty-year cycles of peak gold production are at least partially accidental.

Our next “cycle” of 1940 to 1970 saw world gold output increase by only 12.98%, far less than the preceding thirty-year period. This “cycle” of rising gold production contains no extremely severe economic crisis that would provide a powerful new stimulus to global gold production. It saw the worst war ever, World War II, which greatly increased prices in terms of not only paper money but of gold.

Sharp rises in gold production follow severe economic crises that lower market prices from above to below the prices of production of commodities. There were no severe economic crises that sharply lowered market prices — calculated in terms of gold — between 1940 and 1970. It is not surprising that this “cycle” of gold production showed by far the least overall increase in gold production of the three “cycles” we are examining.

Our final cycle — 1970 to 2001 — sees a sharper increase in gold production of 75.68%. Unlike the preceding cycle this cycle saw a tremendous decline in the golden prices of commodities — see Anwar Shaikh “Capitalism” page 64 (graph above) — brought on by the 1970s “stagflation crisis.” The collapse of the market prices of commodities calculated in terms of the use value of gold bullion stimulated global gold production in a way that was not simulated between 1940 and 1970. The result was that world gold production increased by 75.68%, just a little less than the 1912-1940 period that contains the super-crisis of 1929-33 and the Great Depression.

These three cycles are by no means identical. The 1912 peak in gold production reflects a combination of rising market prices and the depletion of the Klondike gold mines with no new geographical discovery to take their place. However, the decisive feature of this “cycle” was not cyclical; it was World War I, which began in August 1914 and ended in November 1918.

These four years greatly increased market prices at a time when market prices were already above the prices of production of most commodities. The inflation — in golden prices — did not end with the war in November 1918 but continued into 1920. This price peak was followed by the sharp deflation of 1921. This deflation marked the nadir of gold production, greatly lowered commodity prices, and stimulated gold production.

Prices were still above the 1914 level and still above the prices of production. As a result, gold production only partially recovered but stayed well below the levels of 1912, though world commodity production, world trade, and prices were all higher than they were in 1912. The depression in gold production lingered on. Only the great stimulus given to gold production by the 1929-32 super-crisis ended the depression in global gold production. The “Great Depression” in commodity production and prices was preceded by a “Great Depression” in the production of gold, the money commodity.

What about the 1940-1970 period? The Depression decade of the 1930s that preceded the 1940 gold production peak saw an exceptionally rapid rise in gold production. Commercial banks — particularly commercial banks in the U.S. — were flooded with reserves. According to the quantity theory of money, this should have been a decade of great inflation. But it wasn’t.

Though the economy rapidly recovered after 1932-1933 — except during the “Roosevelt recession” of 1937-38 — the starting point of this recovery was so depressed that rising production could still keep up with the increase in demand.

Before excess capacity and unemployment could drop to the level where the ability of production to keep pace with growing demand was seriously compromised, the war economy of World War II took over. The huge budget deficits of World War II mobilized the huge reserves of idle money that had piled up in the banks during the Depression, which generated a huge increase in demand that finally overwhelmed the ability of industrial capitalists to increase production.

It wasn’t just men and women drawn into industry in unprecedented numbers; soldiers and machines mobilized for the great slaughter. It was money as well.

The inflation that had not occurred during the 1930s finally arrived. The rising prices weren’t in terms of depreciating currency (price graph in Anwar Shaikh’s “Capitalism”); they occurred in terms of gold. The consequent rise in prices — despite the attempts to check price increases by price controls — caused the production of gold that had been increasing so rapidly up to the war to begin to decline sharply. The great boom in gold production that occurred during the Depression was over.

After the war and the immediate post-war inflation had run their course, gold production began to recover at a very slow pace. But unlike the situation after World War I, gold and idle bank reserves were extremely plentiful, especially in the United States.

Like human beings and factory machines, money had been mobilized for the war. But unlike human beings and machines, money had not suffered causalities.

As a result, there were only limited economic crises after the war while overall economic growth was rapid, and prices gradually drifted upward. Thanks to war and immediate post-war inflation, market prices were now well above the price of production.

As a result, the production of gold increased very slowly. Because gold production was increasing much more slowly than the production of non-money commodities, interest rates were higher during each boom peak and recession bottom than in the preceding peak and recession. The secular rising interest interests between 1946 and 1970 were the signal that this period of accelerated economic growth that followed World War II was temporary.

As bank reserves increased only slowly thanks to the slow rate of increase in the world gold supply, bank reserves, though increasing absolutely, were shrinking relative to rising production and circulation of commodities measured in terms of their price tags. As a result, though interest started at very low levels, it progressively increased from 1946 onward.

Since the rate of (long) term interest cannot for long rise above the rate of profit, it was only a matter of time before the post-war boom would end. Though the “long boom” was attributed to the enlightened Keynes-influenced government policies by most professional economists and political pundits, its real roots lay in the Depression, which had so strongly stimulated gold production.

The huge excess of gold that was produced during the Depression provided the huge stagnant hoard of potential demand that was gradually mobilized during the years between 1946 and 1970. Once the expanding circulation of commodities fully absorbed this extraordinary Depression-created hoard of money, the “great boom” was over. The Keynesian measures that seemed to work so well between 1946 and 1970 lost their effectiveness.

Conditions were very different during the next thirty-year period, separating the peaks of gold production in 1970 from the next one in 2001. Starting in the mid-1960s, the sharp escalation of the Vietnam War, combined with the Keynes-inspired economic policies of the Lyndon Johnson administration, led to a new wave of inflation in 1965. Between the brief Korean War inflation of 1950-51 and 1965, the rate of inflation was very low.

This period of stable prices had allowed gold production to continue to increase, if only very slowly. However, after 1965, prices began to increase more rapidly, though not at the rate they had increased during World War I and World War II. Again, these price increases were in terms of gold. If the prices of commodities had been well below their prices of production, as they had been during the 1930s, this would not have been a big problem. However, unlike the 1930s, prices in the 1960s were high relative to the prices of production.

Price increases transformed a slow rise in gold production into a stagnation of gold production and then a new depression in gold production that started in 1970. Unlike in earlier periods, the U.S. government and its monetary authority, the Federal Reserve System, reacted to the decline in gold production, not by reducing or at least restricting the creation of dollar currency. Instead, they attempted to demonetize gold to keep the good times rolling.

But for all the reasons we have examined throughout this blog, this policy inevitably failed. The “U.S. dollar price of gold,” which measures how much gold every U.S. dollar represents in circulation, rose from $35 in 1970 to $875 in January 1980. We have examined the resulting economic crisis in the preceding posts.

Unlike the period between 1940 and 1970, where prices were either rising rapidly in terms of gold or were already above the prices of production, between 1970 and 1980, prices when measured in terms of gold as opposed to in terms of devalued U.S. dollars, not only didn’t rise but fell sharply. Indeed, they fell below the levels of the early 1930s.

Starting in the 1980s, this powerfully stimulated gold production. While gold production rose only 12.98% between 1940 and 1970, between 1970 and 2001, the next peak in gold production rose by 75.68%, which was only slightly less than the rise in gold production that occurred between 1912 and 1940. As gold production began to rise in the 1980s, the U.S. dollar and other currencies stabilized — though the gold exchange standard was not restored — and a mass expansion of the worldwide market for commodities occurred.

Next month, we will examine how this renewed prosperity ended in 2008 and how the new crisis-affected gold production. Studying this crisis gives us many clues about the future of capitalism.

Here are some generalizations: If new rich gold mines are not discovered over time, the depletion of existing gold mines will increase the value of gold relative to non-money commodities. According to the quantity theory of money, this should be reflected by a fall in prices, but little else should change since money is “neutral.” But this is far from the case.

If gold mines are being depleted without being replaced by new rich mines, the period of depression/stagnation that follows and an economic crisis will be extended. An economic crisis of overproduction signals to capitalist society that it has been devoting too little of the total labor available to producing money material and too much to producing non-money commodities, overproduction. Once the crisis occurs, society has to reduce the production of non-money commodities while increasing the production of the money commodity. This is what we saw in the 1930s and again in the 1980s and 1990s.

Just as individual businesses have to rebuild their balance sheets after an economic crisis by increasing the amount of cash or near cash they hold relative to other assets, the consolidated balance sheet of capitalist society must also be rebuilt.

This is done by increasing the quantity of gold measured in terms of its weight relative to other commodities measured in terms of their price tags calculated in terms of (imaginary) weights of gold. If the need to rebuild balance sheets coincides with the discovery of rich new gold mines that lower the value of gold relative to non-money commodities, the quantity of money material will increase rapidly. The faster the quantity of money material — gold bullion — grows, the shorter the depression/stagnation that follows the crisis will be.

If there is a long period without the discovery of rich new gold mines, or prices in terms of gold rise so much that even rich new gold mines are not profitable to exploit, a massive economic crisis will occur, such as those of the 1930s or 1970s that again stimulate a new rise in the production of gold. In that case market prices — again always calculated in terms of use value of the money commodity — will fall so far below the prices of production that gold production will be stimulated even if rich new gold mines have not been discovered.

The condition for a major expansion of the world market remains — as it has since the world market first came into existence in the 16th century — is a sharp and sustained rise in the production of the monetary metals. This can be brought about either by the discovery of rich new mines or technical breakthroughs that enable the extraction of gold from poorer ores or by a massive drop of the market prices measured in terms of the use value of money material below their prices of production that can only be brought on by a major economic crisis.

The more the world is thoroughly explored by capital, the less likely the discovery of real massive new mines becomes, and the more likely that a major rise in gold production will be the result of a major economic crisis that again stimulates the production of money material.

The entire process, using Anwar Shaikh’s language, is a turbulent movement. Since the productivity of labor is constantly changing the values of commodities, including gold, are constantly changing. In addition, market prices are constantly fluctuating around the ever-changing prices of production.

Three basic cases regarding the way changes in the value of gold affect the capitalist economy.

Case one is where the relative value of gold and the mass of non-money commodities remains unchanged. In that case, market prices will fluctuate around stable production prices.

Case two is where the value of gold is falling because, for whatever reason, the gold mining industry’s productivity is growing faster than the labor productivity in the production of other commodities. In that case, market prices will fluctuate around rising production prices. In this case, crises will be weaker, and the period of depression/stagnation that follows every crisis will be shortened.

Finally, there is the case where the value of gold rises relative to the value of non-money commodities. This means the productivity of labor is rising more slowly, if not falling, in the mining and refining industries than the productivity of labor is rising in the production of non-money commodities. In this third case, market prices will fluctuate around an axis of falling production prices that are always measured in terms of the use value of gold. The golden prices will fall more in crises than they will rise in periods of prosperity. Because rebuilding a large surplus of idle money capital will take a longer period than in the other two cases, the periods of stagnation that follow a crisis will be extended, and the surplus population will grow relative to the active working population.

A peculiarity of money material

When a commodity that functions as raw material becomes more expensive due, for example, to the depletion of mines, the capitalists that use this commodity search for cheaper substitutes. As a result, demand for commodities that are products of mines that are becoming exhausted tends to decline as their prices rise. This, in turn, limits the further depletion of these mines, and there is time for advancing technology to develop to extract more raw material from poor grades of ores.

This does not work in the same way with the product of mines that produce money material — gold. When gold rises in value relative to other commodities, the demand for it increases even further. A rise in the value of gold leads to increasing purchasing power of gold. This makes gold even more desirable to hold as money material. It seems more likely than not that gold mines will be depleted at a faster rate than the mines producing non-money commodities.

The effects on profits of changing prices

If prices are generally rising, all other things remaining equal, the rate of profit measured in terms of money material will rise relative to the rate of profit measured in terms of values — quantities of embodied labor measured by some unit in time. In this case, the rate of profit will be higher in terms of money than it will be in terms of value.

Conversely, if market prices are falling, the rate and mass of profit will be lower in monetary terms than they will be in value terms. The Monthly Review School believes that the alleged ability of giant corporations under monopoly capitalism to prevent prices from ever falling and their ability to increase prices creates extra profits called “profits upon alienation.”

We see that when ever-changing market prices rise above the prices of production, the rate of increase in the production of gold bullion declines, and if the rise of prices above the prices of production is sufficient, the production of gold bullion will decline in absolute terms. Examples of this are the period between the outbreak of World War I in August 1914 and until the year 1920, during World War II, and, to a lesser extent, during the Vietnam War in the late 1960s.

Such price movements by depressing gold production led to severe economic crises sooner or later. These severe economic crises, in turn, lower market prices back below the prices of production in terms of the use value of the money commodity. As prices fall, extra profits are replaced by losses brought about by the falling — in terms of money material — price level. In the long run, “profits upon alienation” are balanced out by “losses upon alienation.”

A fall in the value of gold relative to non-money commodities does indeed increase the rate of profits, but only temporarily. A rising relative value of gold likewise depresses profits temporarily. If the value of gold began to fall rapidly and continuously against the value of other commodities, the gap between profit measured directly in terms of value and profit measured in terms of the value of money material would widen tremendously. The result would be to undermine gold’s role as the money commodity that would end in its demonetization as happened with silver in the late 19th century and its replacement by another money commodity.

A demonetization of gold caused by a massive drop in its value would also whip out the money capital accumulated since the beginning of capitalism — and to a certain extent, even before capitalism. This would throw the capitalist system into deep crisis. A new money commodity would have to emerge and would have to be produced in sufficient quantity to restore the quantity of money capital that is necessary for capitalism to function normally.

The opposite situation would be a depletion of gold mines that is so severe the consequent decline in prices in terms of gold would be unable to trigger a new boom in gold production. This would make it very difficult for the capitalists to realize profits in terms of money material. If this were a permanent situation as opposed to a temporary situation, it would lead to an economic breakdown of the capitalist system.

This would occur because it would no longer be possible for the capitalists to realize in terms of the use value of the money commodity the ever-increasing mass of surplus value capitalism must produce if it is to continue, even if the conditions of producing additional surplus were very favorable.

This would be the exhaustion of the world market. Without adequate growth of the market, capitalism cannot exist because capitalism is a system of the production of an ever-increasing mass of surplus value. This continuous increase in the mass of surplus value must be matched by an increase in the quantity of money material if a rising mass of surplus value is to be translated into an ever-increasing mass of profit.

To be continued.

(1) I (Sam Williams) will be personally voting for another candidate: Claudia de la Cruz and her running mate Karina Garcia, the candidates of the Party for Socialism and Liberation, and some other state-level electoral socialist parties such as California’s Peace and Freedom Party. I am speaking here personally and not for the editors of this blog, who are entitled to their own views on this year’s elections.

Unlike the middle-class Green Party, the Party for Socialism and Liberation bases itself on the working class and aims to bring it to political power to build a socialist and ultimately a communist society as foreseen by Marx, Engels, Lenin, Rosa Luxemburg and other great Marxist teachers and leaders. We’ve seen how quickly the German Green Party, the prototype of other national Green Parties, including the U.S. version, degenerated into a pro-war, pro-NATO party once it gained a degree of political power. When voting for candidates running for public office, I always vote for political parties taking into account their class base and programs, and not for any personal preference for the individual candidates.

In the U.S., in the past, there was often more than one socialist candidate from various socialist political parties. Over the decades, these have included the Socialist Labor Party, the Socialist Party, the Communist Party of the United States, the Socialist Workers Party, the Workers World Party, and the Party for Socialism and Liberation. This often raised the question of which socialist party to vote for. This year the parties listed above are either no longer active, not running a presidential candidate, or in the case of the CPUSA, supporting the Democratic Harris-Waltz campaign as the only practical alternative to Trump’s “fascism.”

The Socialist Workers Party is a special case. The SWP, as it’s done in every presidential election since 1948, is running a presidential candidate. It has degenerated so much politically that, against its historical positions, it supports the genocide in Gaza. This in and of itself excludes their candidates from any serious consideration of even a mildly progressive person, indeed any person opposing the current genocide for simple, humane reasons, let alone any person upholding socialist or communist positions. This is not to mention the SWP’s support of the Supreme Court’s Dobb’s decision that took away a woman’s right to choose as a constitutional right and other far-right positions the SWP has adopted in recent years.

Since there is no mass labor union-supported working-class candidate running independently of the capitalist parties this year, Claudia de la Cruz and Karina Garcia, in my opinion, are the sole choices for any class-conscious worker in this year’s presidential election. On a positive note, PSL is a party of activists, it has played a leading role in organizing the struggle against U.S.-supported Israeli genocide and in many other struggles as well. I am personally — not in the name of this blog — urging a vote for comrades Claudia de la Cruz and Karina Garcia for president and vice president of the United States, respectively. (back)

(2) To pass a constitutional amendment in the U.S., both Houses of Congress must pass it by a two-thirds majority and then be ratified by three-quarters of state legislatures. (back)

(3) Tropical hurricanes form over warm ocean waters in or near the tropics. Stimulated by global warming, the two major hurricanes, Helene and Milton, formed within days of one another. Helene hit the Florida panhandle but affected the peninsula with heavy rains and strong winds as it passed and moved north, devastating much of the Southeast with flooding rains while moving inland. Milton passed over the Central Florida peninsula, generating unusually strong tornadoes as well as hurricane-force winds directly associated with tropical cyclones. Hurricane Milton dropped more flooding rains, adding to those dropped by Helene.

The immediate result was an increase in unemployment as businesses shut down due to power failures and floods. As rebuilding begins, employment will be temporarily boosted (and be reported in the media as “blow-out jobs numbers”). (back)

(4) Being convicted of a felony by capitalist courts should not disqualify working-class candidates. Sometimes, it’s an honor, as with Eugene Debs. In Trump’s case, he’s not only committed crimes from the viewpoint of the working class, he’s also a felon under capitalist laws. (back)